Customer Insights on a Shoestring (Budget)

How I got to know my customers with no capital.

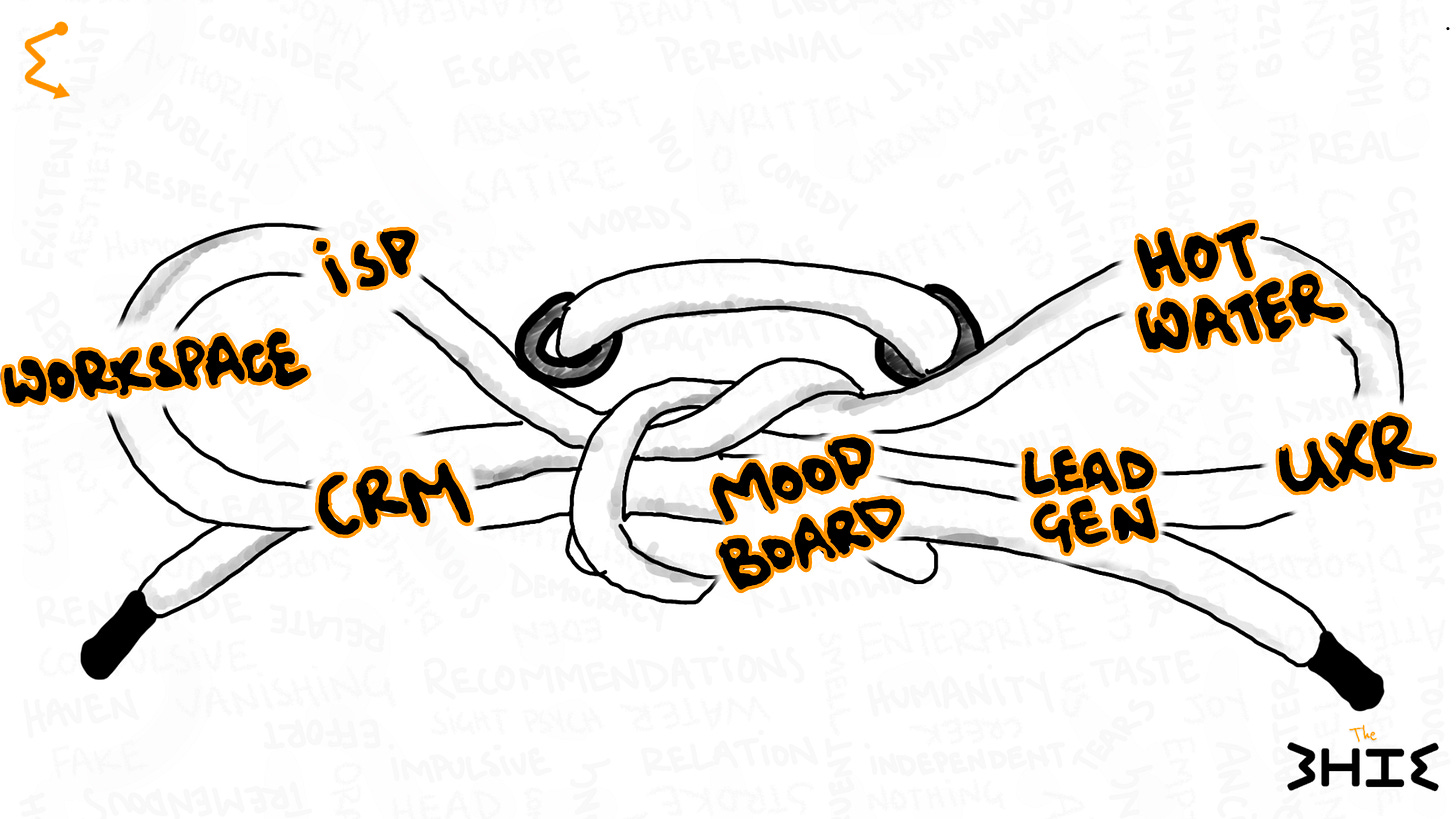

When using it as a metaphor, my “shoestring” stack for generating customer insights comprised of:

A stable internet connection (public libraries are good)

Google Workspace (standard, $15/mth); branded business email, recorded Google Meet, Gemini AI, appointment booking

Dovetail account (free tier)

Hubspot account (free tier); Attio looked good too

Free trials for lead generation tools; LinkedIn sales navigator, Instantly, Dripify, etc.

Stagger the trials to optimize each platform

Very painful to maintain CRM when moving through each one but I had no money

Granola AI Basic (free tier)

Miro Board (free tier)

Daily showers at the end of the day to forget I’m crying

Context

Starting a venture from zero (like, literally) was a painful education of managing priorities and re-evaluating their order of importance on an hourly basis. Fortunately, I’m a psychological masochist. Just kidding. Probably.

I had no cash flow so there wasn’t a buffer to conduct a longitudinal study, exhausting primary and secondary sources, followed by a rigorous analysis of the data collected towards publishing a beautifully crafted report on the evolution of the “Add to Cart” button in eCommerce.

I had access to a stable eCommerce platform, a reliable supplier, and a curious nature. By the way, how are you?

I wanted to grow the marketplace I was building, but I only had a general understanding of the market I was building for and I didn’t even know for sure who my target customer was.

Product-Market Fit

What I learned early is that product-market fit isn’t a precious gem that you’re mining for. It’s the greased-up deaf guy from Family Guy that you’re trying to catch.

It’s an ongoing process that you may catch, but will slip away once you think you’ve won. Also, the market is deaf so you should try a variety of communication techniques (the metaphor isn’t as strong here). Martina Lauchengco describes finding product-market fit as a “discovery and rediscovery” process in LOVED. But that felt cyclical and stupid. Like Ralph Wiggum easter egg hunting.

What I did learn and found helpful was Lauchengco describing the process of determining market fit as “taking inputs from discovery work and applying them to what people are likely to truly do in real-life conditions” [chapter 11, LOVED]. This was a big contrast to my experience in design research where the discovery work was to the end of creating delightful and helpful user experiences.

For customer and market research, I needed to generate insights to position and message my product to make it desirable - to make my customer need it and then do something about that feeling.

Customer and Market Research

So how do you get these insights when you have no money and need to prioritize growth? You repurpose a mediocre growth opportunity as a great customer research opportunity. This is a take on the old adage, “one man’s garbage is another man’s gold.” I took a sales call with a lead and read the situation to evaluate if it would serve better as a customer research opportunity.

I never treated my positioning as complete, especially with a prospective customer who was not resonating with my messaging. Instead, I took it as an opportunity to test hypotheses for different positioning and I started to notice patterns emerging. I was creating customer personas from the bottom-up with my “garbage” sales calls.

A simple case: there were two clinics that offered the same services, with the same revenue, in the same region, with many of the same clinicians working at both clinics. But only one of the clinics used my product. When the sales call was going nowhere with the non-customer, I transitioned to just learning about what’s different about their clinic.

I learned that they are right next to a rehab centre who is their primary referral source for cases, which meant that their priorities were completely different and how I was positioning the product was of little consequence to them. I pivoted to test other positioning that highlighted different value propositions for my product. It didn’t lead to a conversion but there was signal.

A customer insight, generated!

To keep with the metaphor, the greased-up deaf guy slipped from my hands but I learned that wearing nitrile-coated gloves allowed me to maintain a grip for a little while longer.

Summary

Collapsing growth and customer research into a tag-team effort is not a scalable solution as you develop a more nuanced understanding of your customer and your sales calls become more intentional. However, this tag-team effort is a very economical solution that can kickstart your search for product-market fit.

If you’re at the very early stages of growth and you have the freedom to be as nimble as you want and experiment as much as you want, this is a great tactic. It allows you to generate actionable, executable, and mutable value in every instance you’re willing to put in effort.

There is also the convenient overlap between a sales call and a customer research call in that they require some of the same key tools:

curiosity

empathy

adaptability

a decent CRM, and

the suspension of belief that your life is a simulation and nothing matters

The last tool isn’t necessary for everyone but hopefully it helps you feel seen if this is a barrier you need to consciously overcome.

Good luck!